Annual Compliance Filing for Private Limited Companies: Low Cost

✅ Trusted by 10,000+ businesses

✅ Fast and Reliable Service

✅ Dedicated Account Manager

₹15,999

Fast and Affordable Private Limited Company Compliance

Ensuring Annual Compliance for Private Limited Companies is essential for maintaining good standing and operational integrity. Regular compliance not only helps in adhering to legal requirements but also builds trust with stakeholders, investors, and regulatory bodies. In this guide, we’ll explore everything you need to know about Annual Compliance for Private Limited Companies, the benefits of compliance, the types of compliance required, and how MyCAfiling can assist you with cost-effective solutions.

An Overview of Annual Private Limited Company Compliance

Annual compliance for Private Limited Companies in India involves fulfilling various legal and regulatory requirements mandated by the Companies Act, of 2013. These requirements ensure that companies operate transparently and responsibly, adhere to corporate governance standards, and maintain proper financial and legal records.

Key Aspects of Annual Compliance:

- Financial Statements: Preparation and submission of financial statements, including balance sheets and profit & loss accounts.

- Annual Return Filing: Filing annual returns with the Registrar of Companies (RoC) to report the company’s activities and financial position.

- Board Meetings: Regular board meetings and maintaining minutes of these meetings.

- Compliance with Tax Regulations: Timely filing of income tax returns and GST returns.

- Statutory Registers: Updating and maintaining various statutory registers as required by law.

What are the Benefits of Private Limited Company Compliance in India?

Adhering to Annual Compliance offers several advantages:

- Legal Protection: Ensures the company operates within the legal framework, minimizing the risk of legal penalties or disputes.

- Enhanced Credibility: Demonstrates transparency and good governance, which can enhance the company’s reputation among investors, clients, and partners.

- Financial Stability: Regular compliance helps in accurate financial reporting and management, which is crucial for business planning and funding.

- Avoid Penalties: Helps in avoiding fines and penalties associated with non-compliance.

- Investor Confidence: Builds trust with investors and stakeholders, making it easier to attract investment and business opportunities.

Types of Compliance for a Company Registered in India

Compliance requirements for Private Limited Companies can be broadly categorized into:

- External Compliance

- Statutory Compliances

- Internal Compliance

- Mandatory Private Limited Company Compliance

- Other Annual Compliance

External Compliance

External compliance refers to fulfilling requirements set by regulatory authorities and external agencies. This includes:

- Registrar of Companies (RoC) Filings: Submitting annual returns and financial statements to the RoC.

- Income Tax Compliance: Filing income tax returns and ensuring tax payments are made on time.

- GST Returns: Filing Goods and Services Tax (GST) returns if applicable.

- Compliance with Labor Laws: Adhering to labor regulations, including provident fund and employee state insurance contributions.

Statutory Compliances

Statutory compliance involves adhering to laws and regulations specified by the Companies Act, 2013, and other relevant legislation:

- Annual Financial Statements: Preparing and filing financial statements, including balance sheets and profit & loss accounts.

- Board Meetings: Holding regular board meetings and maintaining minutes.

- Shareholder Meetings: Conducting annual general meetings (AGMs) and filing resolutions with the RoC.

- Maintenance of Statutory Registers: Updating registers such as the register of directors, members, and shareholders.

Internal Compliance

Internal compliance includes maintaining proper internal controls and ensuring that the company’s operations align with its internal policies and procedures:

- Internal Audits: Conducting regular internal audits to assess the effectiveness of internal controls.

- Compliance with Company Policies: Ensuring adherence to company policies on various aspects, including financial management, human resources, and operations.

- Risk Management: Implementing risk management strategies to identify and mitigate potential risks.

Mandatory Private Limited Company Compliance

Mandatory compliance refers to requirements that every Private Limited Company must fulfill regardless of its size or type of business:

- Company Registration: Ensuring the company is properly registered and its details are up to date with the RoC.

- Director KYC: Filing Know Your Customer (KYC) details of directors with the RoC.

- Annual Return Filing: Filing annual returns with the RoC to provide an overview of the company’s activities and financial performance.

Other Annual Compliance for Private Limited Companies in India

Additional compliance requirements may include:

- Tax Audit: If the company’s turnover exceeds a specified limit, a tax audit may be required.

- Compliance with Environmental Regulations: Adhering to environmental laws and regulations if applicable to the company’s operations.

- Filing of Financial Reports: Submitting financial reports to regulatory bodies or stakeholders as required.

Event-Based Compliance for Private Limited Company

Event-based compliance involves fulfilling requirements triggered by specific events or changes in the company’s status:

- Changes in Company Structure: Filing documents with the RoC if there are changes in the company’s structure, such as a change in directors or registered office.

- Amendments to Memorandum or Articles of Association: Updating the company’s memorandum or articles of association if there are changes in the company’s objectives or rules.

- Share Transfers: Reporting share transfers and changes in shareholding to the RoC.

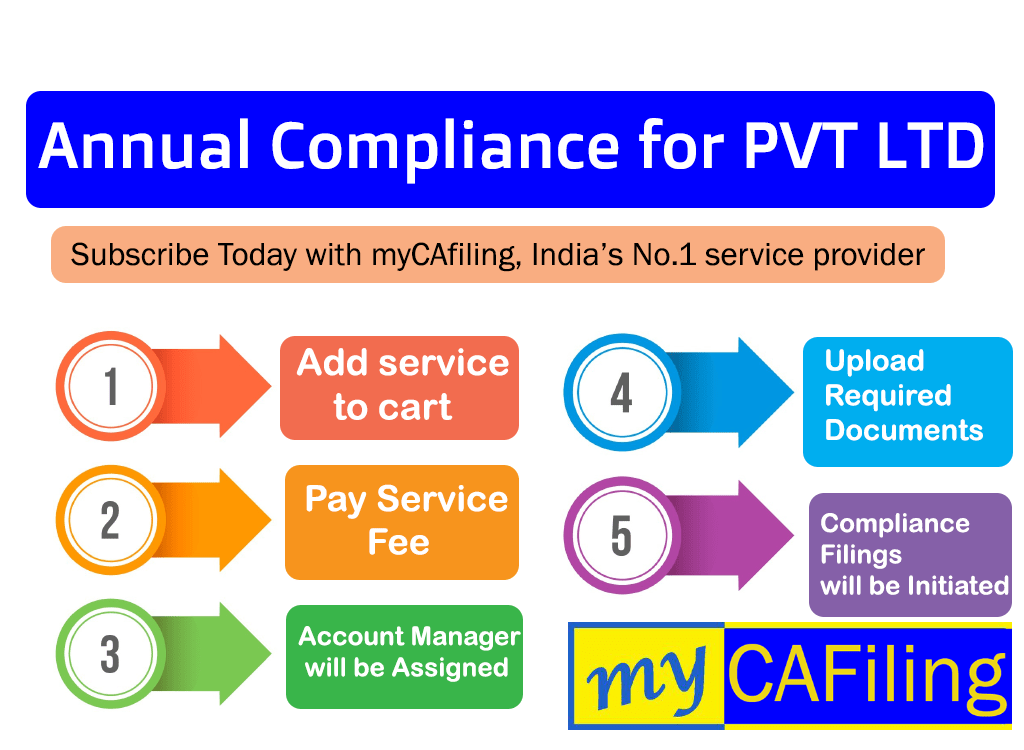

Why MyCAfiling?

MyCAfiling offers a comprehensive solution for Annual Compliance at a low cost. Here’s why choosing MyCAfiling is beneficial:

- Expert Assistance: Professional guidance to ensure all compliance requirements are met efficiently and accurately.

- Affordable Services: Cost-effective solutions for annual compliance, making it accessible for businesses of all sizes.

- Streamlined Process: A user-friendly platform that simplifies the compliance process, saving you time and effort.

- Timely Filings: Ensures that all filings and submissions are made on time to avoid penalties and legal issues.

- Comprehensive Support: Assistance with not only annual compliance but also with other legal and regulatory requirements.

FAQs

- What is Annual Compliance?

Annual compliance refers to the legal and regulatory requirements that a Private Limited Company must fulfill every year. - Why is Annual Compliance important?

It ensures legal adherence, avoids penalties, enhances credibility, and maintains financial stability. - What are the key aspects of Annual Compliance?

Key aspects include financial statements, annual return filing, board meetings, and tax compliance. - How often must a company hold board meetings?

Companies must hold at least four board meetings each year, with not more than 120 days between two meetings. - What is the deadline for filing annual returns with the RoC?

Annual returns must be filed within 60 days of holding the annual general meeting (AGM). - What are statutory registers?

Statutory registers are official records that a company must maintain, including registers of directors, members, and shareholders. - What is a tax audit?

A tax audit is an examination of a company’s financial records to ensure compliance with tax laws, required for companies exceeding certain turnover limits. - How can I ensure timely compliance?

Use services like MyCAfiling to manage and track compliance deadlines effectively. - What are the penalties for non-compliance?

Penalties can include fines, legal action, and suspension or cancellation of registration. - What is the role of a company secretary in compliance?

A company secretary ensures that all regulatory requirements are met and maintains proper documentation. - Can a company be deregistered for non-compliance?

Yes, persistent non-compliance can lead to the deregistration or closure of the company. - How does GST impact annual compliance?

GST compliance involves timely filing of GST returns and maintaining proper GST records. - What is the procedure for changing company directors?

Notify the RoC of changes in directors by filing the necessary forms and updating the statutory registers. - How can I manage internal compliance effectively?

Implement robust internal controls, conduct regular audits, and ensure adherence to company policies. - What is the significance of the annual general meeting (AGM)?

The AGM is a key requirement for reporting the company’s financial performance and conducting shareholder meetings. - How often should financial statements be prepared?

Financial statements should be prepared annually and submitted to the RoC and shareholders. - What are event-based compliance requirements?

Requirements triggered by specific events, such as changes in company structure or amendments to the company’s documents. - Can I handle compliance in-house?

Yes, but it may be more efficient to use services like MyCAfiling for expert assistance and to ensure accuracy. - What is the procedure for updating the company’s registered office address?

File a notice of change of address with the RoC and update the statutory registers accordingly. - How does MyCAfiling assist with annual compliance?

MyCAfiling provides expert guidance, affordable services, and streamlined processes for managing annual compliance efficiently.

Conclusion

Annual Compliance is a critical aspect of managing a Private Limited Company in India. It ensures legal adherence, enhances credibility, and supports financial stability. By understanding the various compliance requirements and leveraging services from MyCAfiling, you can efficiently manage your company’s compliance needs at a low cost. Register with MyCAfiling today and take advantage of their comprehensive and cost-effective compliance solutions.

| View All Services |

| MCA website |

Based on 287 reviews

|

|

|

52.96% |

|

|

|

47.04% |

|

|

|

0% |

|

|

|

0% |

|

|

|

0% |

You must be logged in to post a review.

287 reviews for Annual Compliance Filing for Private Limited Companies: Low Cost

- 12a 80g Registration

- 12a Registration For Section 8 Company

- 80g Registration For Section 8 Company

- Annual Compliance Of LLP

- Annual Filing Forms For LLP

- Annual Filing LLP

- Annual Filing Of LLP After Incorporation

- Annual Filing Of LLP With ROC

- Annual Filings For LLP

- Charity Trust Registration

- Company Liquidation

- Mandir Trust Registration

- Ngo Procedure For Registration

- Ngo Registration

- Ngo Registration Online

- Ngo Registration Process

- Private Trust Registration

- Procedure To Register Ngo

- Procedure To Start An Ngo

- Process To Register Ngo

- Public Trust Register

- Register A Trust

- Register Ngo Online

- Register Of Trust Deeds

- Register Section 8 Company

- Register Trust Online

- Registration Of Non Governmental Organization

- Registration Of Startup In India

- Sec 8 Companies Act

- Sec 8 Company

- Section 8 Company Registration

- Section 8 Company Registration Fees

- Section 8 Company Registration Online

- Section 8 In Companies Act 2013

- Section 8 Microfinance Company Registration

- Section 8 Microfinance Company Registration Fees

- Section 8 Ngo Registration

- Startup India Registration Eligibility

- Startup India Registration Online

- Startup India Registration Process

- Trust Deed Registration

- Trust Registration

- Trust Registration Online

- Voluntary Liquidation

- Winding Up Of A Company

Sangeeta Sinha (verified owner) –

Best service for annual compliance filing with MyCAfiling. Affordable and efficient!

Anil Aggarwal (verified owner) –

Affordable and reliable annual compliance filing for private limited companies with MyCAfiling. Excellent service!

Amit (verified owner) –

Great value for annual compliance filing with MyCAfiling. Low cost and efficient service!

Lata (verified owner) –

MyCAfiling offers low-cost annual compliance filing with excellent support. Highly satisfied!

Saurabh Bansal (verified owner) –

MyCAfiling made annual compliance filing for my private limited company cost-effective and hassle-free. Highly satisfied!

Rakesh (verified owner) –

Excellent annual compliance filing service for private limited companies with MyCAfiling. Affordable and efficient!

Harsh (verified owner) –

MyCAfiling offers low-cost annual compliance filing with excellent support. Highly satisfied!

Karan (verified owner) –

MyCAfiling made the annual compliance filing process straightforward and affordable. Highly satisfied!

Mona Vyas (verified owner) –

Excellent annual compliance filing service for private limited companies with MyCAfiling. Affordable and efficient!

Urmila Vyas (verified owner) –

Fast and budget-friendly annual compliance filing for private limited companies with MyCAfiling. Great value!

Geeta Kapoor (verified owner) –

MyCAfiling offers low-cost annual compliance filing with outstanding support. Highly recommend!

Savita Lamba (verified owner) –

Affordable and effective annual compliance filing with MyCAfiling. Excellent support!

Sunil (verified owner) –

Affordable and reliable annual compliance filing for private limited companies with MyCAfiling. Excellent service!

Rahul Sehgal (verified owner) –

MyCAfiling provided outstanding service for annual compliance filing at a very low cost. Highly recommend!

Nidhi (verified owner) –

MyCAfiling made annual compliance filing easy and affordable for my private limited company. Highly recommend!